Home

Pre-payroll Manual Adjustment

Top of Page

Introduction

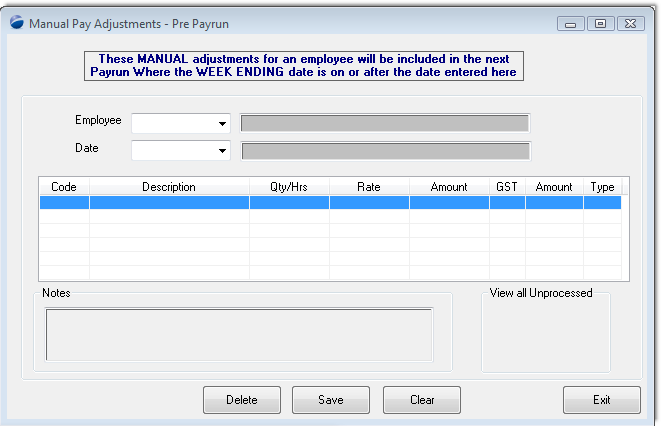

In the case of where you are preparing payroll in advance, you may know what incidental (vs regular) adjustments need to be made for an employee. Rather than wait for the day of the payrun, you may pre-prepare the adjustments prior to the payrun. When the pay is subsequently processed these manual adjustments will be drawn into the payrun and processed accordingly.

Top of Page

Step 1 - Select your Employee

Select an active employee for the dropdown and enter a date effective for the adjustment to take effect. As the caption above says, ensure the date is covered in the week ending date that you will subsequently run the payrun with.

Top of Page

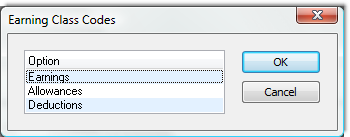

Select the type of Adjustment / Deduction

The type of adjustment is governed by the codes for the above classes that you have previously set up in your system.

Top of Page

Section

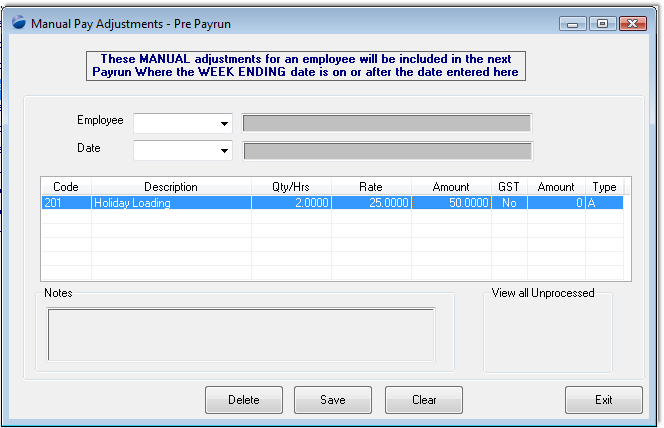

This is an example adjustment for a holiday loading which was not included in a regular payrun or perhaps a holiday loading been given in addition to the regular payrun.

Top of Page

See Also

PowerForce Controls PowerForce Controls

|